Second of three parts

The disposable glove market faces several unique cost drivers that impact the industry. Prices are expected to rise due to factors including increased factory utilization rates, higher prices for raw materials, and a weakening U.S. dollar.

Also looming large for disposable glove manufacturers is the trinity of labor, operational, and logistics costs. A good deal of the workforce for SE Asia factories is transient labor imported to Malaysia and other nations, which can make labor costs unpredictable.

Another post-pandemic reality has involved factory utilization. As excess inventory grew in the wake of the pandemic, demand for gloves cooled. Producers who had made record profits during 2020-21 found themselves struggling from 2022-24 to achieve 50% utilization, a threshold needed to ensure profitability. Now that a substantial portion of that inventory has been reduced, manufacturers can once again concentrate on more normal production schedules.

The U.S. dollar has weakened to its lowest level this year. U.S. inflation has been nearing the Fed’s 2% target and officials have expressed growing concerns over a slowing labor market, which could be a harbinger of interest rate cuts. Lower interest rates in the U.S. would likely weaken the dollar even further.

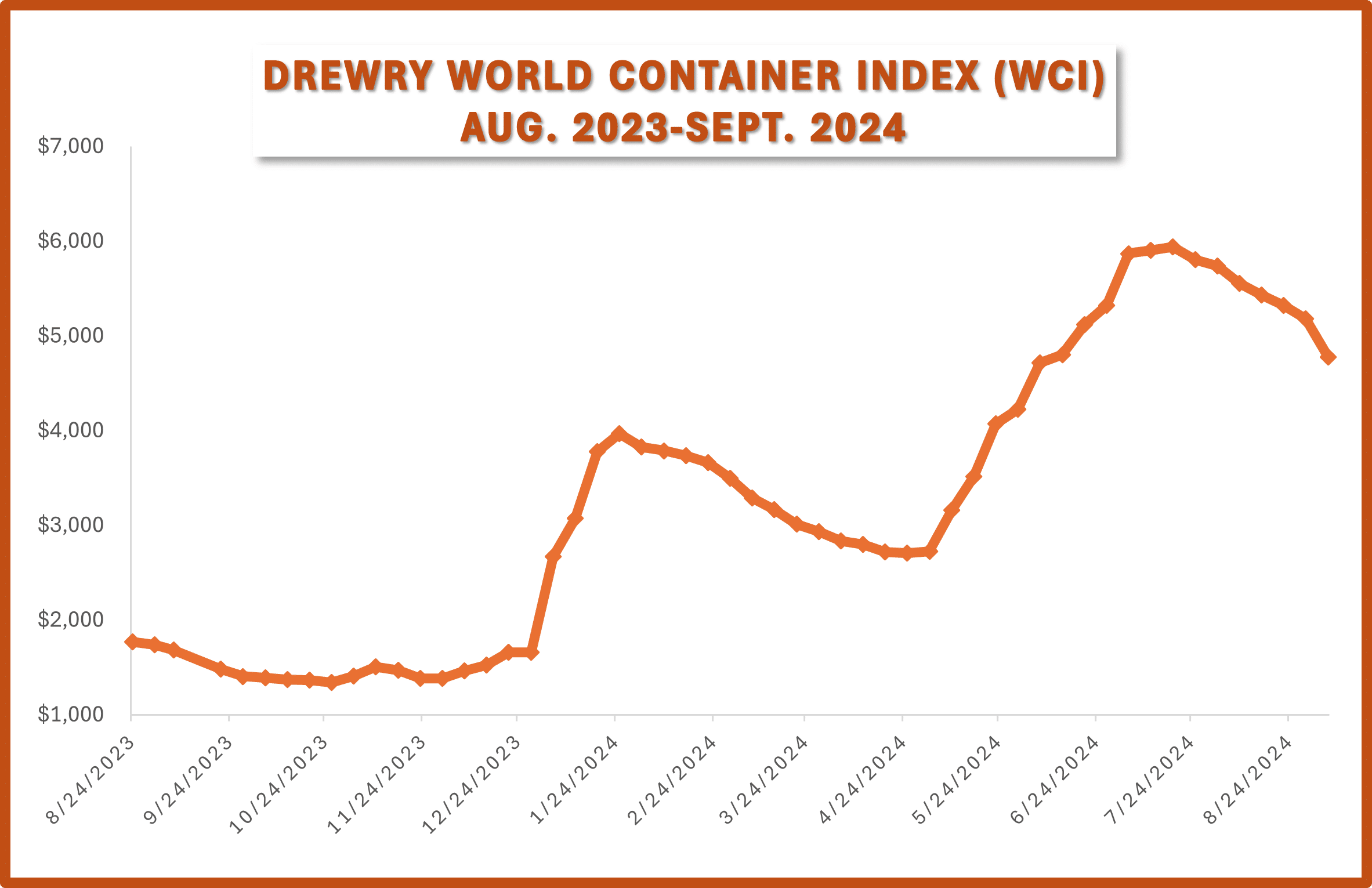

Logistics such as ocean container shipping and domestic transport also factor into overall costs. Global trade has been under pressure since the Israeli-Hamas war broke out in October 2023. The conflict has caused transit to be rerouted around Africa’s Cape of Good Hope, increasing sailing times and driving up both fuel and insurance costs. Adverse weather conditions, notorious around the Cape, are expected to cause further delays and capacity challenges to U.S. East Coast ports.

Departures from Asia have remained strong, helped by extra ship loader capacity to alleviate the backlog from the summer’s cargo rush. With clients reporting healthy inventory levels, however, demand may soften in the weeks ahead.

These events have forced some cargo normally bound for the U.S. East Coast to head instead for the West Coast, which creates congestion in Los Angeles and Asian ports and increases transport costs for truck or rail shipping across the U.S. A potential strike by dockworkers on the East and Gulf coasts that could have seriously damaged the U.S. economy was called off after only three days, as the two sides agreed to a 62% wage increase over six years.

Juggling containers is never an easy task

Spot/floating rates for full-size shipping containers have in recent weeks seemed to be leveling off. This is at least partially driven by an ocean container shortage and congestion; ocean carriers have been skipping ports or decreasing their time at port and not picking up empty containers to keep vessels on track for delivery. They are continuing to adjust schedules in anticipation of the upcoming holiday/Chinese New Year seasons.

Everyone along every step of the supply chain is managing for efficiency. With the peak holiday season looming in North America, shipping companies are especially careful about managing capacity. The pressure to keep costs low while boosting utilization on the factory level—without substantially increasing capacity—is also becoming more intense, and the need for long-range planning by vendors has never been greater.

As we have noted, China has taken a larger role in the disposable glove market. While factories in other SE Asia nations such as Malaysia struggled to overcome utilization challenges, China offered lower pricing and ran their factories at close to full capacity.

There will be further changes ahead with upcoming U.S. tariffs on Chinese disposable glove imports. The U.S. trade representative recently announced that tariffs on medical and surgical gloves from China will rise to 50% in 2025 and 100% in 2026. This will likely push all nitrile prices higher.

Read our full Market Update for Q4 of 2024.