Third of four parts

Spot rates for ocean freight from SE Asia to the U.S. have been rising recently and are expected to continue that trend until Chinese New Year in early 2025. Rates popped between 36%-41% month over month, and ocean carriers increased additional charges, known as general rate increases, by roughly 140%.

Longer transits that avoid the Red Sea routes because of continuing attacks by Houthi rebels—which resulted in a shipping container capacity shortage and canceled sailings from Asia—are stoking spot ocean freight rates.

The Houthis’ monthslong campaign against ships in the area shows no signs of slowing. Spot container rates have doubled since early May. Adding to container bottlenecks is a demand reflex honed during the pandemic: the fear of missing out. Looming U.S. tariffs on Chinese imports are boosting orders sooner than usual.

Inflation also continues to play a role in rising costs, with insurance rates one of the main contributors. U.S. commercial insurance prices continued their upward climb in the first quarter of 2024, rising 6.3% in the aggregate over the fourth quarter of 2023, according to a survey of U.S. property & casualty insurers by WTW.

The commercial property & casualty insurance market has endured significant price fluctuations in recent years, according to WTW. Aggregate prices spiked nearly 10% in most of 2020, then declined to just below 5% in 2022, but prices have since risen.

The price of motor vehicle insurance, which especially impacts last-mile delivery charges, rose more than 22 percent in the year through April, the fastest pace since the 1970s, according to a report from the Bureau of Labor Statistics.

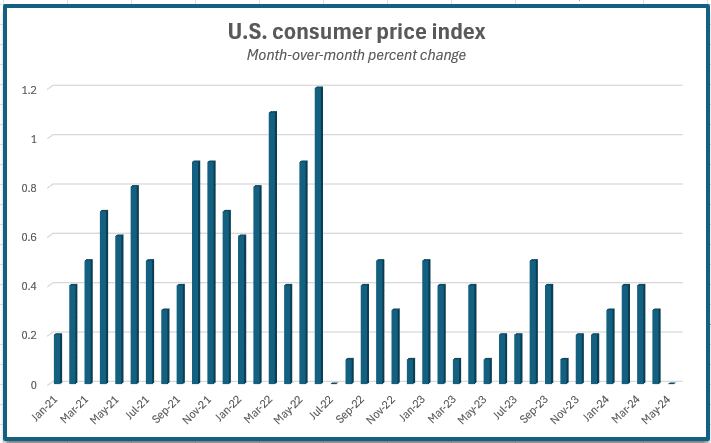

Rising insurance rates may be a prominent factor in preventing overall inflation from cooling more quickly, which could force the Federal Reserve to keep interest rates higher for longer even as the prices for many other essential goods and services have slowed.

The U.S. dollar has performed well against other currencies. Southeast Asian currencies have all struggled to gain ground on their U.S. counterpart, but there is no guarantee that such levels will hold throughout the year, and it is likely that the dollar will fluctuate for the rest of 2024.

Things are OK for now—but keeping a close watch on the strength of the U.S. greenback is advisable.

Download the full Q3 2024 Disposable Glove Market Update.